Synthetic Divide

Deepfakes, Voice Clones Fuel 148% Surge in AI Impersonation Scams

Unite.AI is committed to rigorous editorial standards. We may receive compensation when you click on links to products we review. Please view our affiliate disclosure.

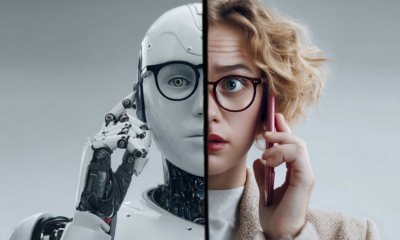

Business professionals and consumers alike are facing a new breed of scammer armed with artificial intelligence. In an era where seeing is no longer believing, criminals are exploiting AI to supercharge old schemes with disturbingly realistic tricks. Recent cases involve everything from deepfake videos to cloned voices and AI-written emails being weaponized for fraud. The result is a meteoric rise in high-tech impersonation cons – the Identity Theft Resource Center reports a staggering 148% spike in impersonation scam cases between April 2024 and March 2025. This wave of AI-enabled scams spans fake business websites, lifelike chatbot “customer service” agents, and even voice-cloned phone calls that mimic real company representatives. Such schemes are so convincing that even savvy professionals have been fooled, prompting urgent warnings from cybersecurity experts and law enforcement.

In fact, the FBI has sounded the alarm that cybercriminals are weaponizing AI to launch highly realistic phishing campaigns and deepfake impersonations. Instead of the clumsy scam emails of the past, today’s fraudulent messages come polished to perfection – often grammatically flawless and tailored to specific victims – while deepfake audio or video can impersonate familiar voices and faces in real time. These AI-powered deception tactics exploit trust and create a false sense of urgency, making targets more likely to be deceived. The consequences of falling victim are serious, ranging from financial fraud to privacy breaches and reputational damage, as discussed below.

The Rapid Evolution of AI-Driven Scams

Only a few years ago, a scam phone call or email was often easy to spot by its odd phrasing or low-quality audio. Now, advances in AI have changed the game. Using deepfake algorithms, fraudsters can generate remarkably realistic video and audio that simulate real people – from CEOs to loved ones. AI voice cloning tools can, with only a short sample, create a “digital twin” of someone’s voice. Scammers have used this trick to impersonate company executives giving orders or family members crying for help. For example, one recent incident involved a con artist cloning a grandson’s voice to convince an elderly victim that her grandchild was in urgent trouble and needed cash fast. In the corporate realm, deepfake audio has been deployed to impersonate CEOs in order to authorize fraudulent wire transfers. In one 2024 case, criminals targeted advertising giant WPP by faking the voice of its CEO during a virtual meeting – a hoax that fortunately was detected in time. Other AI voice scams have successfully fooled bank staff and duped financial firms out of millions of dollars, showing how effective these techniques can be.

Beyond voice and video, generative AI is being used to write phishing messages and create fake websites with uncanny accuracy. Sophisticated phishing emails now arrive devoid of the tell-tale typos or awkward grammar that once gave scammers away. Attackers are leveraging AI to craft targeted phishing messages that read as if a professional wrote them – complete with proper grammar and personalized details – boosting the likelihood of successful deception and data theft. At the same time, criminals can churn out entire counterfeit business websites that look eerily legitimate. These fraudulent sites often come complete with convincing AI-driven chatbots and cloned voice agents posing as real company representatives to lure victims into entering passwords, credit card numbers, or other sensitive information. Impersonating trusted organizations is a common strategy – the ITRC found that over half of impersonation scams last year involved scammers posing as legitimate businesses, and another 21% pretended to be financial institutions.

As a further evolution, some fraudsters are even using AI to fabricate “synthetic identities.” This involves blending real and fake personal data to create a fictitious persona that passes as a legitimate individual. With AI-generated profile photos and plausible personal details, criminals can open bank accounts or lines of credit under these synthetic personas, effectively committing identity theft in a stealthy new way. In essence, synthetic identities combine real and fake data to appear genuine, enabling fraudsters to open accounts or commit identity theft. This tactic lets them bypass traditional identity checks by masquerading as a completely new (but fake) person, making it harder for banks or credit bureaus to detect the fraud.

Real-World Risks: Fraud, Theft and Reputation Damage

The implications of these AI-fueled scams are severe and very real. Victims can suffer direct financial losses as money is siphoned away or fraudulent charges pile up. They may also face stolen personal information and full-blown identity theft if criminals harvest and misuse their data. A successful deepfake or impersonation scam can drain bank accounts, rack up debts, or hijack sensitive accounts before the victim even realizes what’s happening. Law enforcement officials warn that these sophisticated tactics are already resulting in devastating financial losses and compromise of sensitive data. Indeed, once scammers gain access – whether through a cleverly spoofed email or a convincing voice call – the monetary and privacy fallout can be catastrophic.

For businesses, the stakes are equally high. A well-executed CEO deepfake scam can trick employees into initiating unauthorized wire transfers or divulging confidential information, potentially costing companies huge sums and legal headaches. Beyond the immediate financial hit, organizations also risk damage to their reputation and customer trust. If news breaks that a company’s executive was impersonated or its brand was used in a scam, clients may grow wary. Even when an attempted fraud is caught in time, the mere existence of these forgeries sows confusion. Companies have had to warn customers and employees about fake communications circulating in their name. For example, WPP – the world’s largest ad firm – revealed that it has been dealing with fraudulent websites and messages impersonating the company’s brand and is working with authorities to shut down those impostors.

Individuals, too, can suffer lasting reputational harm from AI fakery. A convincingly faked video or audio clip can spread online and tarnish a person’s good name before the truth is uncovered. In one disturbing case, a school principal in Baltimore was put on leave after an audio recording surfaced of him making offensive comments – only for investigators to discover it was a malicious deepfake generated by a colleague. Such incidents highlight a chilling reality: AI-generated lies can not only steal money or data, but also malign an innocent person’s character. For public figures and private citizens alike, the erosion of trust caused by deepfakes is a serious concern. When anyone can be made to “say” or “do” anything on video, it becomes much harder to trust what we see and hear, undermining confidence in legitimate communications.

How to Recognize and Prevent AI Scams

While AI scams are growing more sophisticated, there are still tell-tale red flags and protective steps that can help foil these frauds. Security experts advise staying alert to any clues that something isn’t right. Often, scammers will create a false sense of urgency – for instance, a caller (perhaps impersonating a boss or family member) demands that you act immediately on an issue. This pressure to skip verification and “do it now” is a classic warning sign. Legitimate institutions rarely insist you bypass all standard procedures at a moment’s notice. If you feel undue urgency, pause and verify through a second channel before taking any action.

Also, trust your instincts if a voice or video interaction feels off. Even the best deepfake technologies sometimes have subtle glitches. A cloned voice may sound unnaturally flat or robotic in tone, and an AI-synthesized video might have slightly mismatched lip-syncing, odd lighting, or unnatural eye movements. Similarly, pay attention to emails or texts that seem too perfect. Many AI-generated phishing messages are immaculately formatted and grammatically correct – far better written than the average human email – yet they might feel oddly generic and lack personal details that a real acquaintance or colleague would include. That paradox of a message being flawless in language but impersonal in content can be a red flag that you’re dealing with an AI-crafted scam.

Another major red flag is any unsolicited request for sensitive information or payment that comes via email, text, or an unexpected phone call. Be extremely wary of messages asking you to provide passwords, account login codes, Social Security numbers, or other personal data. Likewise, requests for payments through unconventional methods — such as cryptocurrency transfers, prepaid debit cards, or gift card codes — are a well-known hallmark of scams, since those forms of payment are hard to trace or reverse once sent. If someone claiming to be from a reputable company or government agency directs you to pay in Bitcoin or gift cards, that’s almost certainly fraud. Always double-check the identity of the requester through official channels. For example, if you get an email that looks like it’s from your bank asking you to update your account, don’t click any links. Instead, call the bank using the number on the back of your credit card or visit their verified website to confirm. AI scams often mimic banks, government agencies, or even friends and family, so independent verification is crucial. A two-minute call can save you from a costly mistake.

In terms of prevention, a few practical steps can dramatically reduce your risk. Limit what personal information you share publicly online – scammers scrape social media for details like your birthday, employer, or family members’ names to make their impersonations more believable. The less you expose, the less they have to work with. Implement strong security on your important accounts: use multi-factor authentication (MFA) wherever available, so that even if a password is stolen, a thief would need that second code or confirmation to break in. Regularly updating your software and devices is also key, since updates often patch security vulnerabilities that hackers exploit. And consider using a password manager to create and store complex, unique passwords – that way, a breach of one site won’t expose the keys to your entire digital life.

Businesses should invest in employee education and technical defenses. Regular training can teach staff how to spot phishing attempts and deepfake tricks, reinforcing a culture of “trust, but verify.” At the same time, modern email security tools can filter out many phishing emails before they ever reach inboxes. Companies might also establish strict policies for verifying any request to transfer funds or share sensitive data – for instance, requiring a secondary sign-off or phone confirmation with a known number. Such measures can halt an AI scam in its tracks, even if the initial contact fooled someone. In short, combining human vigilance with smart security technology is the best recipe for staying safe.

No matter how careful you are, it’s wise to prepare for the possibility that some personal data could still be compromised – whether through a data breach, a leaked password, or an AI scam that slips past defenses. This is where identity theft protection and monitoring services can provide an extra safety net.

Bolstering Defenses with NordProtect

One promising solution for peace of mind is to use a trusted identity protection service that watches for misuse of your personal information. For example, NordVPN’s NordProtect offers a comprehensive suite of safeguards designed for the age of AI scams. NordProtect provides around-the-clock dark web monitoring, scanning criminal forums and data dumps to alert you if your personal data (like email addresses, passwords, or Social Security number) is detected circulating where it shouldn’t. It also includes credit and identity tracking – keeping an eye on your credit files and public records for any sudden changes or new accounts that could indicate someone fraudulently using your identity. Users receive instant security alerts the moment a threat or irregular activity is spotted, enabling quick action to lock down accounts before damage is done.

Importantly, services like NordProtect don’t just monitor; they help you respond. NordProtect comes with dedicated support and even financial protection to assist victims of identity crime. In fact, it offers up to $1 million in identity theft recovery insurance coverage, helping cover costs like legal fees or stolen funds if the worst-case scenario occurs. That kind of backing can be a lifesaver in recovering from an AI scam’s fallout. By using a solution such as NordProtect in tandem with good security habits, individuals and businesses can dramatically strengthen their defense against deepfake and AI-driven scams.

In conclusion, staying ahead of AI-powered fraud requires both vigilance and the right tools. The scam landscape may be evolving at breakneck speed with deepfakes, voice clones, and synthetic identities, but awareness and preparation can tip the balance back in favor of the defenders. By knowing the red flags of these new scams, practicing verification and skepticism, and leveraging trusted protective services like NordProtect, you can reduce the risk of falling victim. In a world where technology is arming the bad actors, it’s never been more critical for the good guys to armor up as well – and to remember that when something feels off, a healthy dose of doubt is your best friend. Stay informed, stay cautious, and you’ll be well positioned to outsmart even the smartest of scammers.