Thought Leaders

Why Enterprise AP Automation Needs More Than a Language Model

78% of AI Tools Are Wrappers. Here’s What the Other 22% Built.

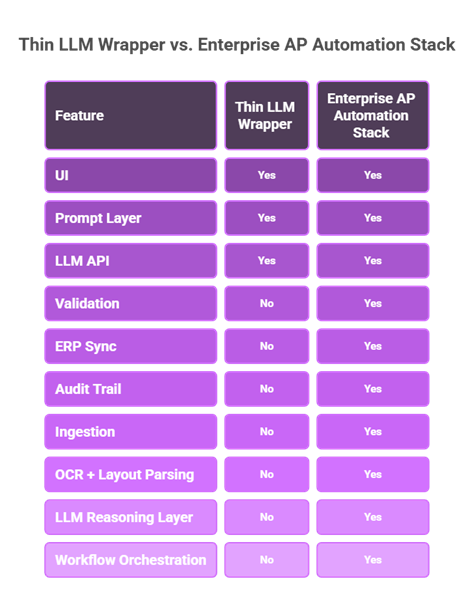

The Accounts Payable automation market is flooded with new entrants. Open Product Hunt on any given day and you will find a dozen tools claiming to “automate invoice processing with AI”. The majority of these tools share a common architecture: a user interface wrapped around an LLM API, some prompt engineering, and not much else.

For certain use cases, that approach works fine, but enterprise AP demands a more sophisticated data technology.

Gartner’s Market Guide for Intelligent Document Processing notes that the IDP market is “dense with vendor offerings” because “commoditized natural language technology has lowered the barrier of entry.” Forrester’s 2025 research found that generative AI “is becoming an equalizer that challenges vendors’ ability to differentiate.”

This proliferation of options is actually good news for buyers since it drives competition and improves pricing. The challenge is knowing which tool fits which job.

For accounts payable specifically, the stakes are different from other AI use cases. You are not generating marketing copy or summarizing meeting notes. You are processing financial data that feeds directly into ERP systems, vendor payments, and audit trails. The margin for error is slim when the output is often a wire transfer.

The Real Gap in AP Today

According to Gartner, AP automation has been CFOs’ top digitization priority for three consecutive years. Yet PwC found that 88% of CFOs struggle to capture value from their technology investments.

Why the disconnect?

Deloitte’s 2023 Global Shared Services Survey points to process complexity, technical integration challenges, and siloed initiatives. Meanwhile, 52% of AP teams still spend over 10 hours weekly processing invoices, and 60% manually key invoice data into their accounting software.

The opportunity here is significant. With the right automation, teams can reclaim thousands of hours annually, but the “right” automation depends entirely on your scale of operations and its complexity.

Where Thin Wrappers Work

A thin wrapper is a minimal layer of code between an LLM API and the end user. The value proposition is the interface, some pre-written prompts, and access to the underlying model.

There are scenarios and use cases where these LLM wrappers work quite well; however, they struggle as soon as it encounters a slight complexity.

Thin wrappers work well when:

- You process low volumes (under 100 invoices monthly)

- Your vendors use consistent, simple, and standard formats

- You do not need deep ERP integration

- Manual review of every output is feasible

Thin wrappers struggle when:

- You need to extract numbers with high precision (LLMs frequently misinterpret numerical data, even with refined prompts)

- Volume requires consistent throughput and predictable costs

- You need real-time audit trails, confidence scores, and exception handling

- Integration with ERP systems needs to be bidirectional and real-time

The distinction is not about “good” versus “bad”, but rather about matching the tool to the task. A startup processing 50 invoices a month has fundamentally different needs than a manufacturer processing 50,000.

What Enterprise AP Actually Requires

Enterprise AP needs more than invoice scanning. It is a complex workflow spanning multiple systems, validation rules, approval hierarchies, and compliance requirements. When invoice volumes increase and compliance requirements tighten, AP automation needs four capabilities that go beyond what language models provide out of the box.

Multi-Format Document Processing

LLMs can process PDFs and common image formats like PNG or JPG, but enterprise AP deals with far more than that. Invoices arrive as EDI transmissions (X12, EDIFACT), XML files (e-invoices), PRN print streams, and TIFF images from legacy scanners. A system that only supports what an LLM can natively read will miss a significant portion of your document flow.

The document length and the character count on each page is another factor. LLMs are constrained by context windows, which means large invoices with hundreds of line items or multi-page contracts can exceed what the model can process in a single pass. Enterprise AP automation needs parsing logic that can work through the documents of any size without truncation or loss of detail.

Deep ERP Integration

ERPs handle accounting and inventory management well, but they are not designed for unstructured AP tasks like invoice processing. The typical workaround involves manual processes that feed data back into the ERP in ways that are slow and error-prone.

Meaningful AP automation requires bidirectional sync with systems like SAP, NetSuite, and QuickBooks, going beyond a simple CSV export or a webhook that fires into the void. It needs an integration that maintains data integrity across platforms and reflects changes in real-time.

ERPs are not the only systems that matter. Enterprises also rely on legacy systems, databases, file transfer protocols like SFTP and AS2, and custom applications that have been running for decades. True AP automation needs to connect with all of these, not just the modern cloud-based tools.

For organizations with multiple ERPs, legacy systems, or hybrid cloud environments, this becomes an integration problem. It requires purpose-built middleware or an integration layer that can orchestrate data flows across disparate systems.

Three-Way Matching and Validation

The core AP challenge of verification includes confirming that purchase orders, delivery receipts, and invoices align before releasing payment. This three-way match prevents overpayments and catches fraud.

Automated matching requires understanding document structure, extracting the right fields, normalizing data across formats, and applying business rules to flag exceptions. The system needs to know which discrepancies need human review and which can be fast-tracked.

This is where domain expertise matters. A system built for AP knows your vendor master file, understands tolerance thresholds, and can route exceptions to the right approver based on amount, department, or GL code.

Workflow Orchestration

Mid-market and enterprise companies have approval flows that vary by department, invoice type, facility, region, and vendor. The marketing team’s expense approvals do not follow the same rules as capital equipment purchases.

Many AP automation platforms lack flexibility for these workflows. They force companies to work around system limitations or revert to manual approvals. This defeats the purpose of automation.

Real workflow orchestration means configurable rules that match how your business actually operates, not how a software vendor thinks businesses should operate.

Real-Time Analytics and Visibility

Knowing what is happening in your AP pipeline at any moment requires more than just logging events. It requires a structured data model behind the scenes that can answer queries in milliseconds.

How many invoices are pending approval?

What is the average processing time this week?

Which vendors have the most exceptions?

These questions need instant answers, not reports that take hours to generate. Real-time dashboards and actionable insights are only possible when a proper data layer sits beneath the workflow, indexing and organizing information for fast retrieval.

Compliance and Audit Trails

Financial processes require complete traceability. Every invoice, approval, edit, and payment needs to be logged with timestamps and user attribution because regulations often require it.

Enterprise security adds another layer through role-based access controls, encrypted storage and transit, data sovereignty options, and the ability to deploy on-premises when regulatory requirements demand it.

The Hybrid Approach That Works

The emerging consensus among practitioners, building production document systems, is that effective document processing combines multiple approaches.

OCR for recognition: Deterministic character recognition with layout analysis does the mechanical work of converting images to text. It is fast, predictable, and produces consistent outputs. With pre- and post-processing of images, its performance improves substantially on low quality scans.

LLMs for reasoning: Language models excel at interpreting context, handling ambiguity, and making judgments about document structure. LLMs capture the spatial and semantic relationship between fields and values on an invoice, helping establish an understanding of the document.

Rules for validation: Business logic ensures the output meets your requirements before it enters downstream system. This includes format validation, threshold checks, duplicate detection, matching, reconciling, and exception flagging.

Integration for action: Extracted data needs to flow into ERP systems, trigger approval workflows, update vendor records, and generate payment files. This requires purpose-built connectors and an understanding of enterprise system architecture.

A research paper on hybrid OCR-LLM frameworks for enterprise document extraction found that combining these approaches delivered near-perfect accuracy with sub-second latency, results that neither OCR nor LLMs achieved alone.

What to Look For

When evaluating AP automation tools, the demo is the easy part. The real test is understanding what happens when reality diverges from the sanitized test case.

Run a pilot with your actual invoices: Skip the curated samples, and experiment with your messiest, most inconsistent vendor invoices, including the ones with handwritten notes, poor scan quality, and non-standard formats A capable system should deal with format variability without requiring weeks of model training or new template for every vendor. Look for adaptive extraction that learns from corrections and improves over time rather than breaking when it encounters something new.

Ask about integration depth: Determine whether it is a prebuilt connector with bidirectional sync or a generic API that requires custom development. The right tool should offer native connectors for major ERPs like SAP, NetSuite, and QuickBooks, with real-time bidirectional data sync. Integration is configuration rather than a six-month implementation project.

Understand the matching logic: Find out whether it can perform three-way matches, r beyond, and what happens when there is a discrepancy. A robust system should automatically match invoices against purchase orders and receipts, flag exceptions based on configurable tolerance thresholds, and route discrepancies to the right approver based on rules you control. Clean invoices should flow through without human touch while exceptions get surfaced with full context for quick resolution.

Check the audit trail: Verify that you can trace every field back to its source document and see who approved what and when. Enterprise-grade AP automation should maintain complete traceability from invoice receipt through payment, with timestamps, user attribution, and document linkage at every step. When auditors ask questions, you should be able to answer them in minutes, not days.

Ask about pricing at scale: If costs are usage-based, calculate what you would pay at 10x your current volume because some tools become economically unfeasible at enterprise scale. Predictable pricing matters, so look for models that do not penalize you for growth or spike unpredictably based on API consumption. The cost per invoice should decrease as volume increases, not the other way around.

Test the exceptions: Intentionally submit invoices that should fail validation to see how the system responds. A tool that auto-approves everything is not automating. It is rubber-stamping. The right system should catch errors, flag anomalies, and require human judgment where it is warranted while providing enough context for reviewers to make fast decisions.

Choosing the Right Fit

The AP automation market has grown rapidly as barriers to entry have dropped. Building a basic LLM wrapper is now straightforward but building systems that hold up in enterprise environments require a different level of engineering.

If you are just extracting data from modest invoice volumes with standard formats and can tolerate manual review, a lighter solution may serve you well. However, if you are processing thousands of invoices across multiple formats, languages, and currencies, you need a deeper infrastructure. You need real-time ERP integration, configurable workflows, custom approval chains, and auditable records that hold up under scrutiny.

What matters most is the system beneath the AI, including the integration layer, the validation logic, the workflow engine, and the domain expertise built over years of understanding how enterprise data actually flows.

AP automation is not a prompt engineering problem. It is a systems engineering problem, and systems built for enterprise reality take time to mature.