Thought Leaders

AI’s Great Role Reversal: White-Collar Jobs Hit 10x Harder – How Should Organisations Prepare?

Traditionally, tech waves elevated humans up the value chain, eliminating lower end tasks. The AI age is breaking that pattern. Knowledge work, largely cognitive and already digitized, is making white-collar jobs more vulnerable to rapid AI automation.

The reversal, already underway, will intensify dramatically over the next 10-15 years. In my book, Human edge in the AI age, I describe the disruption unfolding in three distinct waves, each characterized by escalating intensity and a broader scope of automation.

The Dawn of AI disruption is here. Over the next five years (2025–30), AI will mostly complement human roles, creating many Human+AI hybrids and temporarily offsetting losses through new AI-centric jobs. But the impact will be uneven. Of the 11–22% of all jobs impacted, nearly 30% will be white-collar workers—over 300 million people, compared to just 10% of blue-collar workers. The job-loss inversion is stark – for every blue-collar job lost, up to ten white-collar roles could disappear. And of the 2–5% of all jobs that may be lost, ~100 million are white-collar (10%), versus ~10 million blue-collar jobs (0.6%).

The Age of Accelerated Disruption will set in, in the medium term (2030-35). As AI matures and computing costs decline, deployment costs will fall sharply. Hybrid roles will also become susceptible to automation. 45–60% of all jobs will be impacted, and 15–35% will be at high risk of being lost. Around 65% of white-collar workers will be exposed, and 35% may lose jobs. Blue-collar workers will also see greater impact – with almost half of them (47%) hit and roughly one in five, at risk of being fully automated.

The Age of Uncertainty dawns in the long run (2035-40) , where the scale of disruption becomes truly unprecedented. As self-sufficient AI and humanoid robots become a reality, automation will become superior and cost-effective across all sectors. Job disruption will be near-universal, with limited new job creation potential. Almost all jobs (90–95%) will be impacted, with 35–50% potentially disappearing. An astounding ~3.3 bn jobs, both white- and blue-collar, would be impacted. Nearly 84% of the white-collar and ~95% of blue-collar jobs will get disrupted. Yet even in the long run, knowledge workers remain disproportionately threatened with ~60% at risk, compared to 35% for blue-collar roles.

Reinventing the workforce: What Banks and Wealth managers must do now

For leaders, especially in banking and wealth management, where talent models rely heavily on knowledge work, the implications are profound. These sectors have long depended on large teams performing analytical, process-driven, advisory tasks, which AI can now execute far faster. Functions like operations, compliance, risk analysis, underwriting, even parts of customer advisory are already being automated.

As disruption accelerates, leaders can no longer rely on incremental measures. They must rethink the human role in the AI age and build the capabilities people need not just to adapt but to thrive.

That means going back to the drawing board.

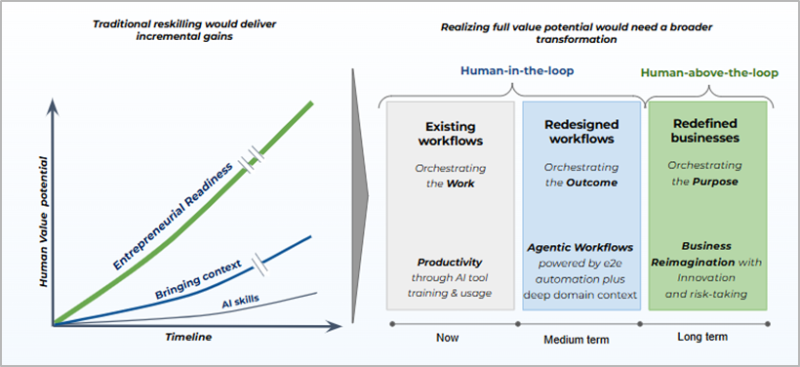

Rising above the loop: A complete reimagination beyond conventional reskilling

It is clear that the traditional reskilling models, built for a slower, predictable world, were designed to extend the relevance of existing roles. But AI does not modify work; it redefines it. With half-life of skills collapsing, slow, linear capability-building leaves organisations far behind, preparing them for only a fraction of emerging opportunities.

As AI evolves, the human role will rise from in-the-loop execution to above-the-loop creation. To prepare, organizations must anchor their strategy in three pivotal pillars that redefine how talent is developed and deployed:

Figure: Future of work demands moving beyond conventional reskilling

AI Skilling: Enhancing productivity of existing workflows

The starting point is AI skilling to achieve practical proficiency in using AI tools to enhance productivity. Banks and wealth managers are already training employees on auto-code tools, AI-driven research assistants, and automated interaction systems. Used effectively, these tools drive quick efficiency gains and better decisions. But mere AI skilling prepares the workforce for today’s tasks, not tomorrow’s work.

Building context: Redesigning workflows to orchestrate outcomes

The next, more demanding imperative, is building context. As agentic workflows become the norm, humans shift from execution to judgment. In banking and wealth management, this means deepening expertise in credit evaluation, portfolio construction, risk management, etc. while rearchitecting legacy processes for end-to-end automation. Humans provide the domain context guiding AI agents as integrated agentic workflows deliver real value. This is not optimisation but a complete redesign of work.

Entrepreneurial readiness: Redefining businesses to orchestrate purpose

The third, most transformative imperative is to build entrepreneurial readiness – enabling real shift to human-above-the-loop. As AI takes over execution-heavy tasks, humans migrate toward creation: new products, businesses, customer engagement models, and entirely new revenue lines. For banks and wealth managers, the real opportunity lies not in just automating old processes; but in reimagining business models – AI-powered advisory services, personalised wealth products, and real-time agentic risk models. Humans above the loop shape purpose, steer innovation and create transformational value.

A disruption that will touch 3.3 billion jobs cannot be met with defensive thinking. Organisations that lead will recognise that the AI age demands reinvention, not protection. By building AI fluency, deepening domain expertise, and fostering entrepreneurial creation, companies can turn historic disruption into unprecedented opportunity. Those that act boldly now won’t just adapt to the AI age – they will define it.

Research note:

For this research, the base numbers for total employment and the split of white-collar and blue-collar have been kept constant for ease of calculations. The total employment numbers are based on World Bank data – the global workforce stands at 3.63 Bn(2023).

Of this, approximately 1.13 billion are projected to be white-collar workers, and the remaining 2.5 billion representing blue-collar roles.

The overall estimated job impact rates and job loss rates have been calculated by taking the average of the base and stretch scenarios data from multiple agencies such as the ILO, WEF, OECD, Morgan Stanley, Goldman Sachs, and Mckinsey.

- Short term wave range estimates: Job Impact (11-22%); Job Lost (2-5%)

- Medium term wave range estimates: Job Impact (45-60%); Job Lost (15-35%)

- Long term wave range estimates: Job Impact (90-95%); Job Lost (35-50%)

To estimate the hybrid and automation impact on white-collar jobs, the analysis draws on McKinsey’s Automation Potential data and Benny Traub’s Human-to-AI Leverage Ratio (HAILR) framework for knowledge workers. These sources project automation potential from 2025 to 2040. Job-loss projections are aligned to the rise of fully autonomous roles, assumed to displace an equivalent share of human jobs.

Sources:

- World of Work – World Employment Confederation

- https://www.forbes.com/councils/forbestechcouncil/2020/12/10/the-year-of-the-knowledge-worker

- https://www.mckinsey.com/capabilities/tech-and-ai/our-insights/the-economic-potential-of-generative-ai-the-next-productivity-frontier

- https://papers.ssrn.com/sol3/papers.cfm?abstract_id=466370

- https://ww3.weforum.org/docs/WEF_Future_of_Jobs_2023.pdf

- https://www.forbes.com/sites/jackkelly/2025/04/25/the-jobs-that-will-fall-first-as-ai-takes-over-the-workplace

- https://www.gspublishing.com/content/research/en/reports/2023/03/27/d64e052b-0f6e-45d7-967b-d7be35fabd16.html